The Roadmap Illusion

How feature-heavy plans create the illusion of progress while fragility builds beneath the surface.

Most organizations struggle with balance.

Some over-invest in features — shipping shiny roadmap items quarter after quarter. The product looks busy, but adoption stalls and debt piles up.

Others over-invest in scaling — spending months “future-proofing” systems for growth that hasn’t arrived yet. Customers barely notice, revenue doesn’t grow as hoped, and momentum slips away.

And almost everywhere, the first bucket to die is innovation. In uncertain times, companies quietly kill long-term bets while startups keep pushing forward. It feels safer to double down on features or scaling, but the result is fragility: you’re optimizing today while starving tomorrow.

Incremental Growth that compounds over time included in the roadmap as a strategic focus? Almost not existent.

Balance isn’t nice-to-have. It’s survival.

The Four Buckets of Product Work

Every healthy product portfolio needs balance across four buckets. Neglect one, and cracks appear — sometimes quickly, sometimes quietly. So let’s look into the four areas.

Feature Work: Customer Love or Feature Factory?

Feature work is the most visible. In one of my previous companies, we called this “customer love” work, inspired by Slack’s Customer Love Sprints. Framing it this way gave it a different energy. It reminded teams that features aren’t just items to ship, but bets to deepen relationships with customers. The trap, of course, is when all you do is chase applause with features while the core problems remain unsolved.

Growth Work: The Difference Between Shipping and Sticking

Growth work is the lifeline that makes features matter. I’ve seen too many organizations cut growth experiments first when the pressure mounts. Funnels leak, retention stalls, but everyone keeps applauding the features being shipped. My perspective here is simple: if you don’t invest in continuous growth, you’re wasting your team’s capacity. A feature nobody adopts is just expensive theater.

Innovation Work: The Insurance Policy for Tomorrow

Innovation is the hardest to defend. It rarely has immediate returns, and in a tough market, it’s the first thing on the chopping block. But I’ve also seen what happens when it dies: the future quietly disappears. Startups keep betting while incumbents retreat, and over time the gap becomes unbridgeable. I’ve come to see innovation less as a luxury and more as insurance. You don’t need to spread bets everywhere, but starving innovation entirely is a slow death.

Scaling & Debt: The Invisible Weight on Velocity

Scaling and debt work is where leadership discipline is tested most. Engineers know when the system is groaning under the weight of shortcuts, compliance gaps, or outages. Leaders often don’t. I’ve been in situations where we ignored this bucket for too long, only to find ourselves unable to move fast when it really mattered. On the other hand I’ve seen teams spending 70% of their time for months if not years on scaling topics, leaving no room for creating measurable impact for the business.

Paying down debt or strengthening systems doesn’t feel like progress in the moment, but it’s what makes progress possible later.

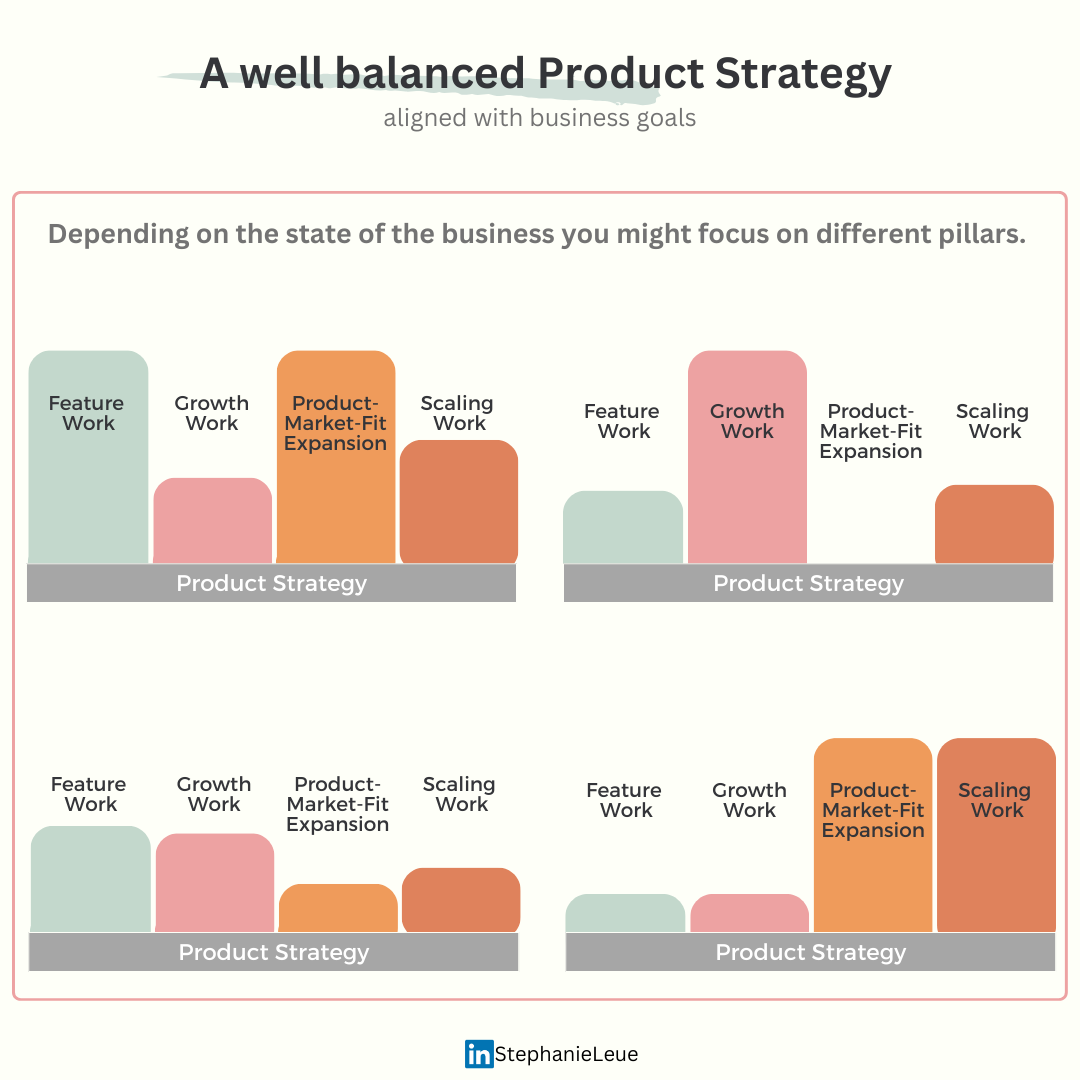

Balance: The Fifth Discipline: What balance looks like in practice

What balance looks like for your organization depends on many factors: product maturity, market pressure, leadership appetite for risk, technical debt, and more. It is never set in stone. That’s why I recommend reviewing allocations every 3–6 months. Ask yourself: are we still spending the right amount of time in the right areas? If not, rebalance before the portfolio quietly drifts toward fragility.

Balance as a Leadership Choice

Balance isn’t about perfect percentages. It’s about being intentional. Without growth, features don’t stick. Without innovation, the future never comes. Without scaling and debt, the system eventually breaks.

Most companies sacrifice balance for comfort. Great leaders defend it—even when it’s invisible, unpopular, or uncertain.

The real strategy isn’t more features. It’s balance.

Why balance is so hard

Balancing these four buckets sounds obvious. In practice, it’s one of the hardest leadership challenges.

Stakeholder bias. Sales want features. Ops want scaling. Finance kills innovation. Everyone has a bias.

Short-term focus. Growth, debt, and innovation rarely show up in next quarter’s KPIs. Features win because they’re visible.

No explicit targets. Most orgs never set clear allocations. Teams guess, and the loudest voice wins.

Market climate. In times like these, risk tolerance is low. Big companies retreat into “safe” bets. Innovation is left to startups.

Invisible wins. Reducing churn, stabilizing systems, or unlocking scalability rarely makes headlines. Without deliberate effort, this work is overlooked.

BUT… How do you get there?

Here’s how I am usually approaching to bring clarity into ongoing product work to manage my portfolio:

Categorize all work. Label everything Feature, Growth, Innovation, or Scaling & Debt. Until you see the imbalance, you can’t fix it.

Set allocation targets. There’s no magic formula, but start with rough guidelines. Example for a mid-stage product: 40% features, 20% growth, 20% scaling & debt, 20% innovation. Adjust by maturity.

Of course, allocation is an artificial construct — we all know unexpected issues will disrupt the plan. But putting it on paper helps. Even if reality diverges, the act of setting explicit targets nudges teams (sometimes consciously, sometimes unconsciously) in the right direction. And that’s still far better than leaving the balance unspoken.

Review quarterly. Early-stage → feature-heavy. Scaling → more infrastructure. Mature → more growth and innovation. The right mix evolves.

Communicate trade-offs. Make costs explicit:

Ignore growth → features don’t stick.

Ignore innovation → stagnation.

Ignore scaling → outages and bottlenecks.

Ignore debt → velocity collapse.

Celebrate invisible wins. Call out scaling, debt, and innovation achievements in demos and all-hands. Show that these are just as strategic as new features.

The bigger lesson

Balance isn’t about perfect percentages. It’s about naming the buckets, setting expectations, and adjusting intentionally as the product evolves.

Because without growth, features don’t matter.

Without innovation, the future never comes.

Without scaling & debt, the system breaks.

Most companies sacrifice balance for comfort. Great leaders defend it — even when it’s invisible, unpopular, or uncertain.

The real strategy isn’t just more features. It’s balance.

Want to go deeper?

In my guide “20 Hard Challenges and How to Solve Them”, I break down the most common traps product leaders face — from feature factories to scaling bottlenecks to the death of innovation.

When a company prioritizes revenue without a clear purpose, it creates innovation theatre—relabeling core (H1/H2) work as innovation while avoiding high-uncertainty bets.

From what I’ve seen, real innovation in large companies only happens in two cases: when a founder actively champions and clears the path, or when the company faces an existential crisis that demands it. Outside of those, I’ve never seen it work.

Is that what you’re seeing as well?